What is the Medicare Prescription Drug Plan?

The Medicare Prescription Payment Plan is a new payment option in the prescription drug law that works with your current drug coverage to help you manage your out-of-pocket Medicare Part D drug costs by spreading them across the calendar year (January-December). Starting in 2025, anyone with a Medicare drug plan or Medicare health plan with drug coverage (like a Medicare Advantage Plan with drug coverage) can use this payment option. All plans offer this payment option and participation is voluntary.

If you select this payment option, each month you’ll continue to pay your plan premium (if you have one), and you’ll get a bill from your health plan to pay for your prescription drugs (instead of paying the pharmacy). There is no additional cost to participate in the Medicare Prescription Payment Plan.

What to know before participating:

How does it work?

When you fill a prescription for a drug covered by Part D, you won’t pay your pharmacy (including mail order and specialty pharmacies). Instead, you’ll get a bill each month from your health plan.

Even though you won’t pay for your drugs at the pharmacy, you’re still responsible for the costs. If you want to know what your drug will cost before you take it home, call your plan or ask the pharmacist.

Please note: This payment option might help you manage your monthly expenses, but it doesn’t save you money or lower your drug costs.

How is my monthly bill calculated?

Your monthly bill is based on what you would have paid for any prescriptions you get, plus your previous month’s balance, divided by the number of months left in the year. All plans use the same formula to calculate your monthly payments.

Your payments might change every month, so you might not know what your exact bill will be ahead of time. Future payments might increase when you fill a new prescription (or refill an existing prescription) because as new out-of-pocket costs get added to your monthly payment, there are fewer months left in the year to spread out your remaining payments.

In a single calendar year (January – December), you’ll never pay more than:

- The total amount you would have paid out of pocket to the pharmacy if you weren’t participating in this payment option.

- The Medicare drug coverage annual out-of-pocket maximum ($2,000 in 2025).

The prescription drug law caps your out-of-pocket drug costs at $2,000 in 2025. This is true for everyone with Medicare drug coverage, even if you don’t participate in the Medicare Prescription Payment Plan.

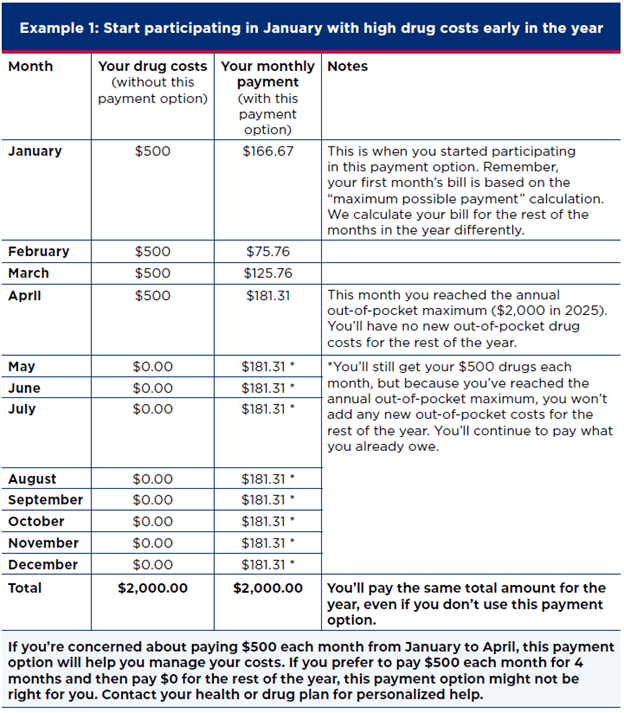

Examples of how a monthly bill is calculated

You take several high-cost drugs that have a total out-of-pocket cost of $500 each month. In January 2025, you join the Medicare Prescription Payment Plan through Alterwood Advantage.

We calculate your first month’s bill in the Medicare Prescription Payment Plan differently than your bill for the rest of the months in the year:

First, we figure out your “maximum possible payment” for the first month:

$2,000 [annual out-of-pocket maximum] – $0 [no out-of-pocket costs before using this payment option] = $2,000

12 [remaining months in the year]

Then, we figure out what you’ll pay for January:

– Compare your total out-of-pocket costs for January ($500) to the “maximum possible payment” we just calculated: $166.67.

– Your plan will bill you the lesser of the two amounts. So, you’ll pay $166.67 for the month of January.

– You have a remaining balance of $333.33 ($500-$166.67).

For February and the rest of the months left in the year, we calculate your payment differently:

$333.33 [remaining balance] + $500 [new costs] = $833.33

11 [remaining months in the year]

We’ll calculate your March payment like we did for February:

$757.57 [remaining balance] + $500 [new costs] = $1,257.57

10 [remaining months in the year]

In April, when you refill your prescriptions again, you’ll reach the annual out-of-pocket maximum for the year ($2,000 in 2025). You’ll continue to pay what you already owe and get your prescription(s), but after April you won’t add any new out-of-pocket costs for the rest of the year.

$1,131.81 [remaining balance] + $500 [new costs] = $1631.81

9 [remaining months in the year]

= $166.67 [your “maximum possible payment” for the first month]

= $75.76 [your payment for February]

= $125.76 [your payment for March]

= $181.31 [your payment for April and all remaining months in the year]

Even though your payment varies each month, by the end of the year, you’ll never pay more than:

The total amount you would have paid out-of-pocket.

The total annual out-of-pocket maximum ($2,000 in 2025).

Remember, this is just your monthly payment for your out-of-pocket drug costs. You still need to pay your health plan’s premium (if you have one) each month.

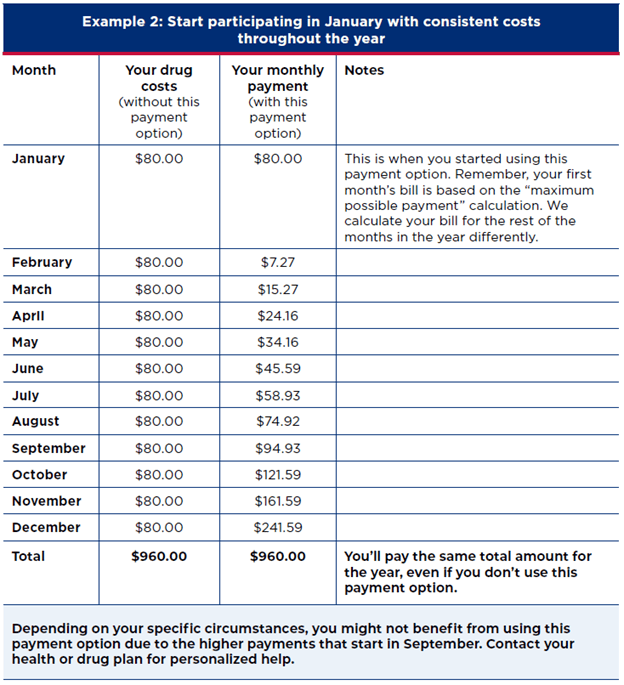

You take several drugs that have a total out-of-pocket cost of $80 each month. In January 2025, you join the Medicare Prescription Payment Plan through Alterwood Advantage.

We calculate your first month’s bill in the Medicare Prescription Payment Plan differently than your bill for the rest of the months in the year:

First, we figure out your “maximum possible payment” for the first month:

$2,000 [annual out-of-pocket maximum] – $0 [no out-of-pocket costs before using this payment option] = $2,000

12 [remaining months in the year]

Then, we figure out what you’ll pay for January:

– Compare your total out-of-pocket costs for January ($80) to the “maximum possible payment” we just calculated: $166.67.

– Your plan will bill you the lesser of the two amounts. So, you’ll pay $80 for the month of January.

– You have a remaining balance of $0.

For February and the rest of the months left in the year, we calculate your payment differently:

$0 [remaining balance] + $80 [new costs] = $80

11 [remaining months in the year]

We’ll calculate your March payment like we did for February:

$72.73 [remaining balance] + $80 [new costs] = $152.73

10 [remaining months in the year]

Even though your payment varies each month, by the end of the year, you’ll never pay more than:

The total amount you would have paid out-of-pocket.

The total annual out-of-pocket maximum ($2,000 in 2025).

Remember, this is just your monthly payment for your out-of-pocket drug costs. You still need to pay your health plan’s premium (if you have one) each month.

= $166.67 [your “maximum possible payment” for the first month]

= $7.27 [your payment for February]

= $15.27 [your payment for March]

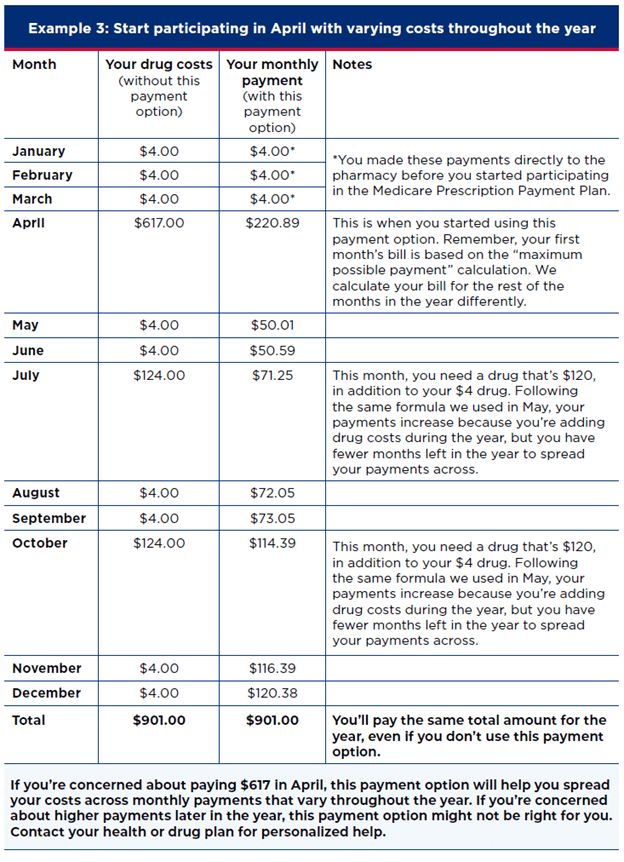

You pay $4 every month in out-of-pocket costs for a prescription you use regularly. In April 2025, you need a new one-time prescription that costs $613, so your total out-of-pocket costs in April are $617. That same month, before you fill your prescriptions, you decide to participate in the Medicare Prescription Payment Plan through Alterwood Advantage.

We calculate your first month’s bill in the Medicare Prescription Payment Plan differently than your bill for the rest of the months in the year:

First, we figure out your “maximum possible payment” for the first month:

$2,000 [annual out-of-pocket maximum] – $12 [your out-of-pocket costs before using this payment option] = $1,988

9 [remaining months in the year]

Then, we figure out what you’ll pay for April:

– Compare your total out-of-pocket costs for April ($617) to the “maximum possible payment” we just calculated: $220.89.

– Your plan will bill you the lesser of the two amounts. So, you’ll pay $220.89 for the month of April.

– You have a remaining balance of $396.11 ($617 – $220.89).

For May and the rest of the months left in the year, we calculate your payment differently:

$396.11 [remaining balance] + $4 [new costs] = $400.11

8 [remaining months in the year]

Your payments will vary throughout the year. That’s because you’re adding drug costs during the year, but you have fewer months left in the year to spread your payments across.

By the end of the year, you’ll never pay more than:

The total amount you would have paid out-of-pocket.

The total annual out-of-pocket maximum ($2,000 in 2025).

Remember, this is just your monthly payment for your out-of-pocket drug costs. You still need to pay your health or drug plan’s premium (if you have one) each month.

= $220.89 [your “maximum possible payment” for the first month]

= $50.01 [your payment for May]

Will the Medicare Prescription Drug Plan help me?

It depends on your situation. Remember, this payment option might help you manage your monthly expenses, but it doesn’t save you money or lower your drug costs. You’re most likely to benefit from participating in the Medicare Prescription Payment Plan if you have high drug costs earlier in the calendar year. Although you can start participating in this payment option at any time in the year, starting earlier in the year (like before September), gives you more months to spread out your drug costs. Go to Medicare.gov/prescription-payment-plan/will-this-help-me to answer a few questions and find out if you’re likely to benefit from this payment option.

This payment option may not be the best choice for you if:

- Your yearly drug costs are low.

- Your drug costs are the same each month.

- You’re considering signing up for the payment option late in the calendar year (after September).

- You don’t want to change how you pay for your drugs.

- You get or are eligible for Extra Help from Medicare.

- You get or are eligible for a Medicare Savings Program.

- You get help paying for your drugs from other organizations, like a State Pharmaceutical Assistance Program (SPAP), a coupon program, or other health coverage.

Who can help me decide if I should participate?

- Alterwood Advantage: Visit our website or call us to get more information. If you need to pick up a prescription urgently, call your plan to discuss your options.

- Medicare: Visit Medicare.gov/prescription-payment-plan to learn more about this payment option and if it might be a good fit for you.

- State Health Insurance Assistance Program (SHIP): Visit shiphelp.org to get the phone number for your local SHIP and get free, personalized health insurance counseling.

How do I sign up?

Visit our website or call us to start participating in this payment option:

- In 2024, for 2025: If you want to participate in the Medicare Prescription Payment Plan for 2025, contact us now. Your participation will start January 1, 2025.

- During 2025: Starting January 1, 2025, you can contact us to start participating in the Medicare Prescription Payment Plan anytime during the calendar year.

Remember, this payment option may not be the best choice for you if you sign up late in the calendar year (after September). This is because as new out-of-pocket drug costs are added to your monthly payment, there are fewer months left in the year to spread out your payments.

What to know if I’m participating?

What happens after I sign up?

Once Alterwood Advantage reviews your participation request, we’ll send you a letter confirming your participation in the Medicare Prescription Payment Plan. Then:

- When you get a prescription for a drug covered by Part D, we will automatically let the pharmacy know that you’re participating in this payment option, and you won’t pay the pharmacy for the prescription.

Even though you won’t pay for your drugs at the pharmacy, you’re still responsible for the costs. If you want to know what your drug will cost before you take it home, call us or ask the pharmacist.

- Each month, your plan will send you a bill with the amount you owe for your prescriptions, when it’s due, and information on how to make a payment. You’ll get a separate bill for your monthly plan premium (if you have one).

How do I pay my bill?

After your health plan approves your participation in the Medicare Prescription Payment Plan, you’ll get a letter from your plan with information about how to pay your bill.

What happens if I don’t pay my bill?

You’ll get a reminder from us if you miss a payment. If you don’t pay your bill by the date listed in that reminder, you’ll be removed from the Medicare Prescription Payment Plan. You’re required to pay the amount you owe, but you won’t pay any interest or fees, even if your payment is late. You can choose to pay that amount all at once or be billed monthly. If you’re removed from the Medicare Prescription Payment Plan, you’ll still be enrolled in Alterwood Advantage.

Always pay your health or drug plan monthly premium first (if you have one), so you don’t lose your drug coverage. If you’re concerned about paying both your monthly plan premium and Medicare Prescription Payment Plan bills, go to page 5 for information about programs that can help lower your costs.

Call us if you think we made a mistake about your Medicare Prescription Payment Plan bill. If you think we made a mistake, you have the right to follow the grievance process found in your Member Handbook or Evidence of Coverage (EOC).

How do I leave?

You can leave the Medicare Prescription Payment Plan at any time by contacting your health plan. Leaving won’t affect your Medicare drug coverage and other Medicare benefits. Keep in mind:

- If you still owe a balance, you’re required to pay the amount you owe, even though you’re no longer participating in this payment option.

- You can choose to pay your balance all at once or be billed monthly.

- You’ll pay the pharmacy directly for new out-of-pocket drug costs after you leave the Medicare Prescription Payment Plan.

What happens if I change health or drug plans?

If you leave your current plan or change to a new Medicare drug plan or Medicare health plan with drug coverage (like a Medicare Advantage Plan with drug coverage), your participation in the Medicare Prescription Payment Plan will end.

Contact your new plan if you’d like to participate in the Medicare Prescription Payment Plan again.

What programs can help lower my costs?

If you have limited income and resources, find out if you’re eligible for one of these programs:

- Extra Help: A Medicare program that helps pay your Medicare drug costs. Visit ssa.gov/medicare/part-d-extra-help to find out if you qualify and apply. You can also apply with your State Medical Assistance (Medicaid) office. Visit Medicare.gov/ExtraHelp to learn more.

- Medicare Savings Programs: State-run programs that might help pay some or all of your Medicare premiums, deductibles, copayments, and coinsurance. Visit Medicare.gov/medicare-savings-programs to learn more.

- State Pharmaceutical Assistance Programs (SPAPs): Programs that might include coverage for your Medicare drug plan premiums and/or cost sharing. SPAP contributions may count toward your Medicare drug coverage out-of-pocket limit. Visit go.medicare.gov/spap to learn more.

- Manufacturer Pharmaceutical Assistance Programs (sometimes called Patient Assistance Programs (PAPs)): Programs from drug manufacturers to help lower drugs costs for people with Medicare. Visit go.medicare.gov/pap to learn more.

Many people qualify for savings and don’t realize it. Visit Medicare.gov/basics/costs/ help, or contact your local Social Security office to learn more. Find your local Social Security office at ssa.gov/locator/.

Where can I get more information?

- Alterwood Advantage: Visit our website or call -us to get more information.

- Medicare: Visit Medicare.gov/prescription-payment-plan, or call 1-800-MEDICARE (1-800-633-4227), 24 hours a day, 7 days a week. TTY users can call 1-877-486-2048.

Access the Medicare Fact Sheet on the Medicare Prescription Payment Plan: English | Spanish